The noise

-

President Trump returned to the Oval Office on Wednesday, less than a week after contracting Coronavirus. He has since described his illness as “a blessing from God”, saying “I learned by really going to the school and this is the real school and this isn't the read the book school. And I get it and I understand it”. Markets wait with baited breath to discover what he might do with this newfound self-declared wisdom.

-

A mere day after being discharged, the President tweeted: “I have instructed my representatives to stop negotiating until after the election” putting US markets into a tailspin; US stocks fell sharply and the S&P 500 Index closed 1.4% down. Despite this, House Speaker Nancy Pelosi and Treasury Secretary Steven Mnuchin remain in contact and the S&P has rallied after the short-term blip.

-

In the wake of rising cases in many parts of the UK, the government has announced plans to create a tiered system of containment measures with some regions of the country potentially having tighter restrictions enforced, including complete closures of bars and pubs. Once again politicians find themselves stuck between a rock and a hard place as they attempt to prevent the spread without doing further damage to already struggling businesses.

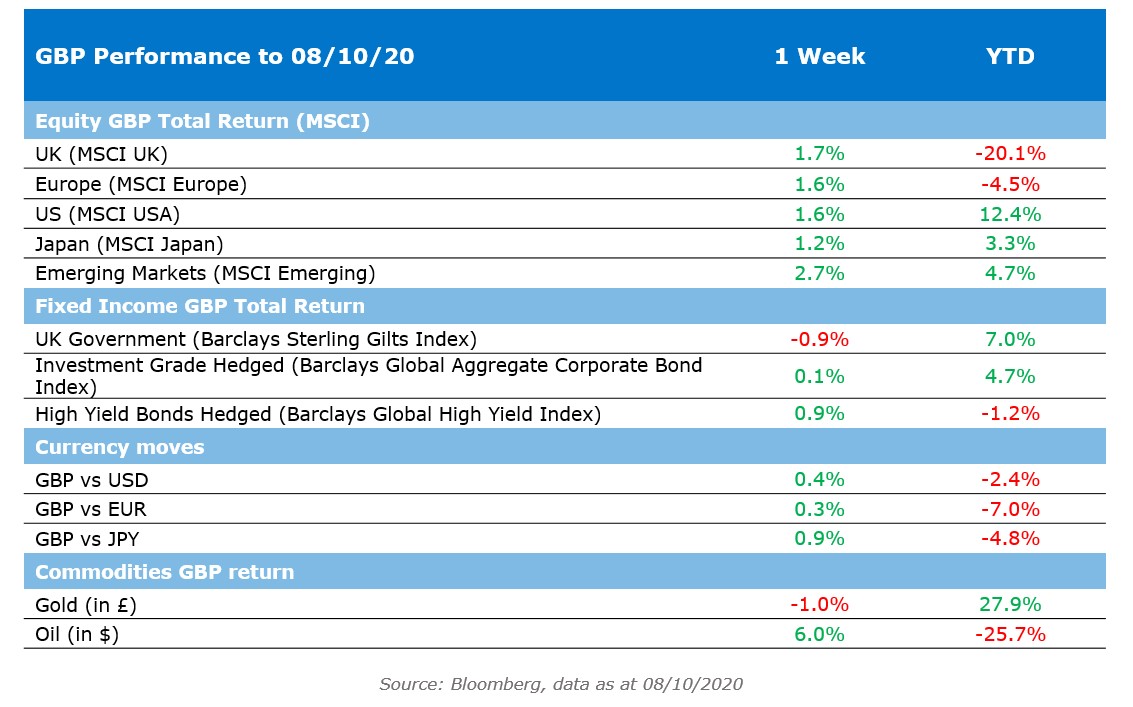

The numbers

The nuance

There has been more of a risk-on feel to markets this week as expectations of a fiscal stimulus have increased, buoying share prices. This goes to show just how much sentiment is driven by fiscal and monetary phenomena, which are currently subject to ongoing political skirmishes and bickering.

However, the short-term fluctuations don’t change the unavoidable fundamental outlook of a long protracted recovery for economies. Financial markets have priced in this recovery already, suppressing the return potential for equities; stock selection will continue to be vital in this environment where easy wins are hard to find.

If investors can lean against some of these swings in sentiment, there is scope to pick up companies when they’re out of favour and trim positions when euphoria creeps in. We make these incremental changes whilst adhering to our core investment philosophy of holding good businesses that are well placed to achieve longer-term returns.

Quote of the week

"These reviews were written out of anger and malice.” - Wesley Barnes, US citizen working in Thailand

An American man has narrowly avoided a two year prison sentence in Thailand… for writing a negative hotel review. Wesley Barnes had posted several reviews accusing the Sea Review Resort of “modern day slavery”. What caused this extreme outburst of emotion? The hotel wouldn’t let him bring his own bottle of wine while dining in the restaurant. He was subsequently detained and charged under Thailand's strict anti-defamation laws. He gave a written statement expressing his regret and the hotel agreed to withdraw the compliant. Mr Barnes is certainly a man who stands up for what he believes in.

Source: www.bbc.co.uk

All investment views are presented for information only and are not a personal recommendation to buy or sell. Past performance is not a reliable indicator of future returns, investing involves risk and the value of investments, and the income from them, may fall as well as rise and are not guaranteed. Investors may not get back the original amount invested.