Summary:

- Infrastructure underpins everyday life and modern economies, covering essential services like energy, transport, digital networks and data centres, and offering investors stable, regulated returns.

- It can strengthen portfolios through resilience and diversification, with steady demand, inflation-linked revenues and low correlation to equities and bonds.

- AI and digital growth are boosting infrastructure demand, especially for data centres and power networks, adding a long-term growth tailwind alongside its defensive qualities.

Infrastructure rarely makes headlines, but it quietly powers everyday life – from the electricity in our homes to the data centres behind AI and cloud computing. For investors, these essential assets can also play a valuable role in building resilient, diversified portfolios.

What do we mean by infrastructure – and why it’s different

Infrastructure investment is all about investing in companies that deliver essential services such as transport systems, energy facilities and telecommunications. These companies often operate in areas that economists characterise as “natural monopolies” – duplicating networks like power grids or rail lines is inefficient, and usually it doesn’t make economic sense to have multiple airports or toll roads service a specific region or city.

As a result, these companies are typically subject to close regulatory oversight, designed to protect consumers and ensure fair pricing, while still allowing investors to earn stable, predictable returns.

Why infrastructure matters today

Infrastructure is often associated with roads, bridges, airports and power lines, but in the investment world, it is much broader. Today it includes renewable energy facilities, cloud data centres, and fibre optic networks, which are the backbone of modern economies and digital transformation. Global economic shifts, sustainability goals, and the rise of artificial intelligence (AI) are creating significant demand for these assets.

How infrastructure can strengthen a portfolio

Infrastructure assets can strengthen portfolios through a combination of diversification, resilience, and reliable income. Demand for essential services tends to persist through economic cycles, making infrastructure a relatively stable source of returns.

Many infrastructure businesses also have revenues linked to inflation, providing protection against rising prices, while their relatively low correlation with equities and bonds can help reduce overall portfolio volatility.

atomos gains exposure to infrastructure through listed investments – investing in shares of infrastructure companies rather than owning physical assets directly. This approach captures the benefits of infrastructure investing while maintaining liquidity and ease of access within portfolios. The allocation provides exposure to resilient, inflation-linked assets that are well positioned to benefit from long-term structural trends.

How AI Is driving new demand for infrastructure

AI is becoming a dominant theme in corporate strategy, although adoption remains uneven. A record number of companies have referenced AI in recent earnings announcements, highlighting its growing role across areas such as customer engagement, software development, and marketing.

While many firms are still in the early stages of integrating AI into their operations, capital expenditure trends confirm the direction of travel. Hyperscale technology companies are rapidly increasing infrastructure spending, and merger and acquisition activity targeting AI capabilities has accelerated.

For example, in Q3 2025 Nvidia reported record revenue of USD 57.0bn, up 62% year on year, including record Data Centre revenue of USD 51.2bn, up 66%. Demand for its Blackwell AI superchips drove these results, signalling continued confidence in sustained investment in AI-related infrastructure.

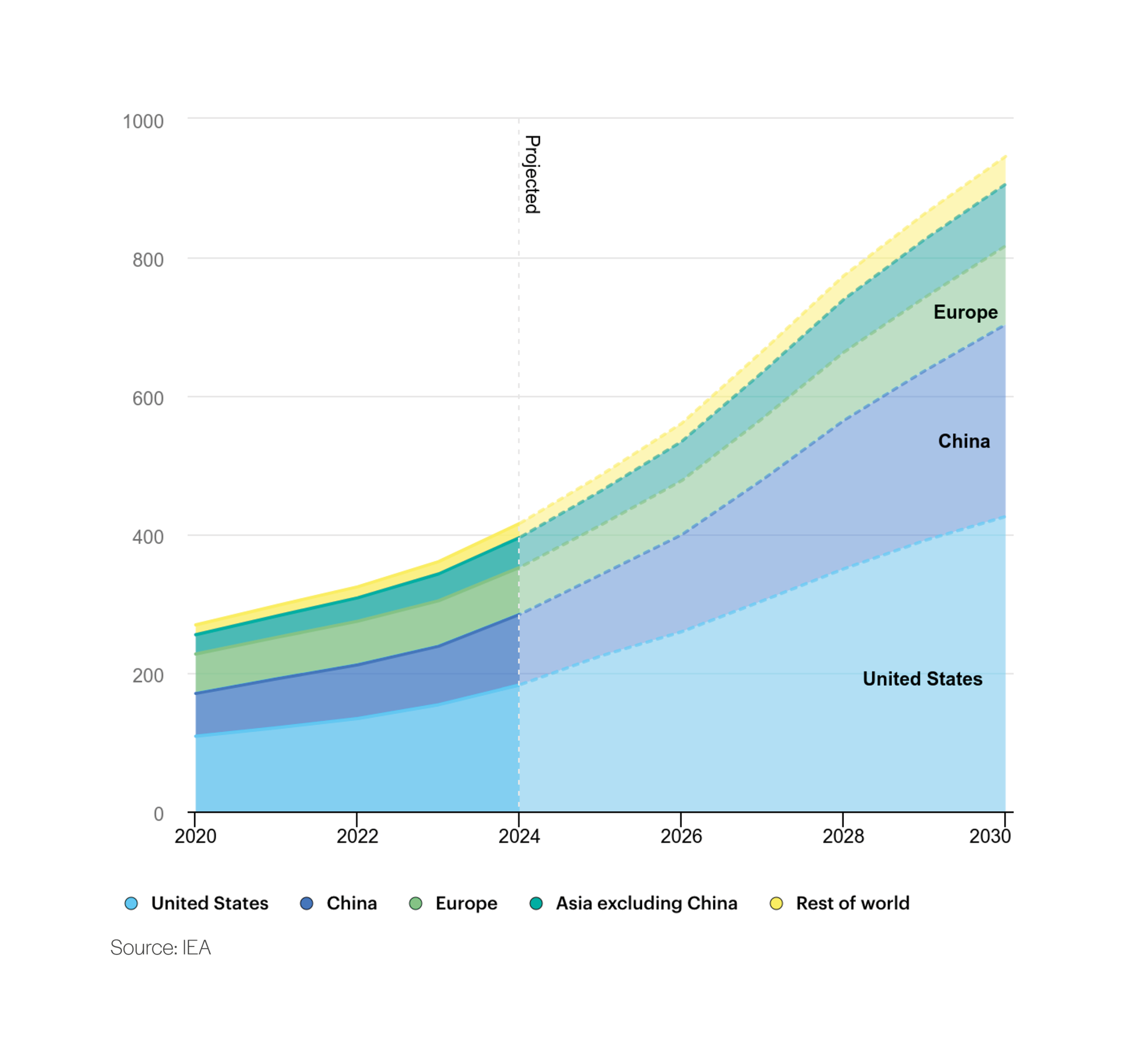

The chart below illustrates projected growth in data centre electricity consumption by region from 2020 to 2030. Consumption increases steadily across all regions, with the U.S. accounting for the largest share, followed by China and Europe. China’s contribution accelerates notably after 2024, reflecting strong projected expansion, while growth in other regions highlights the increasingly global nature of data centre demand.