Exclusive financial planning support for senior employees

Our dedicated team are here to provide guidance to senior employees on their holistic financial planning needs including inheritance tax (IHT), estate planning, retirement planning, charitable giving and a range of investment options.

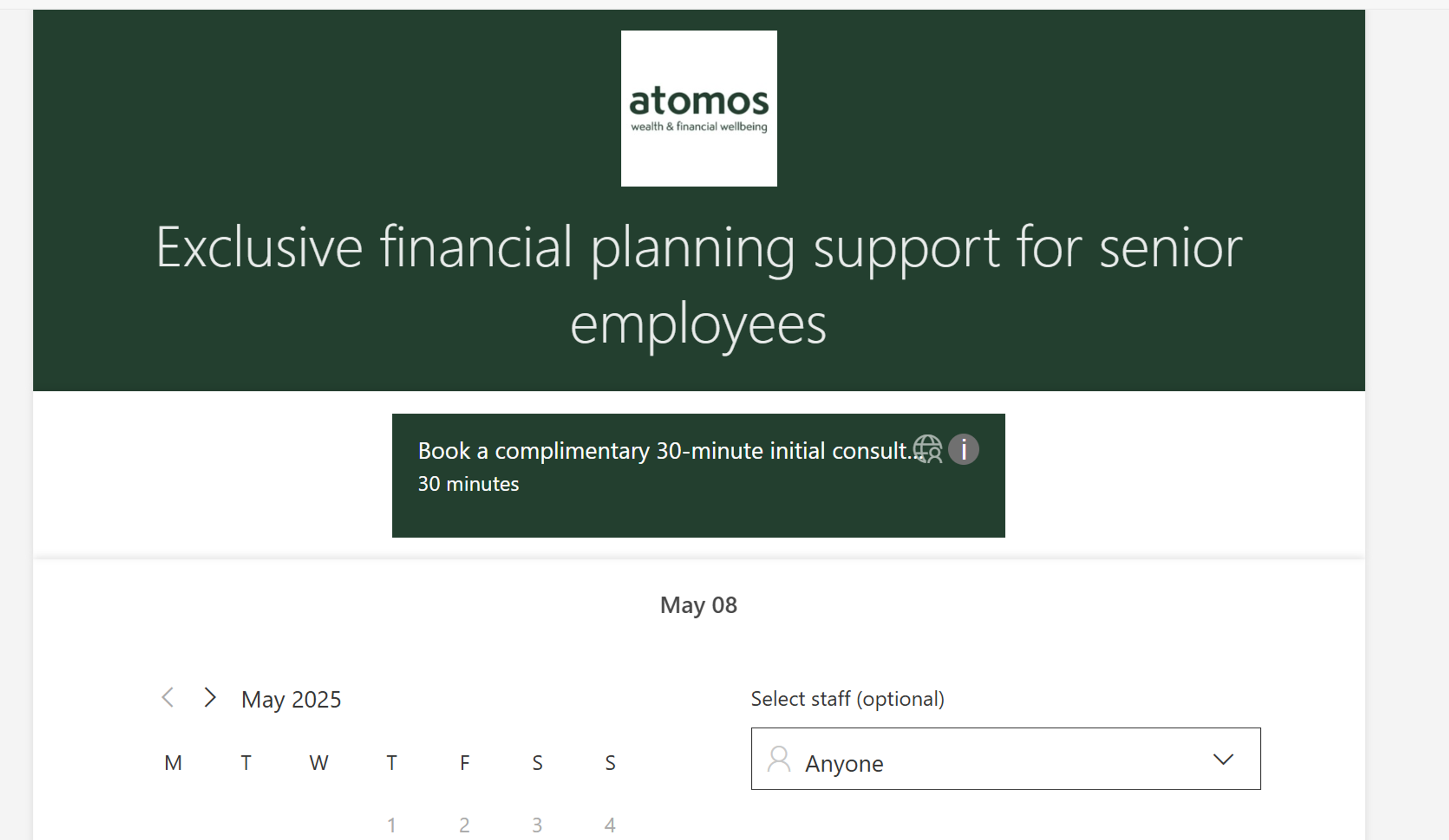

Book an appointment