In practical terms, volatility means that markets don’t move in a straight line. Prices rise and fall in response to news, economic data, investor sentiment, and increasingly, short-term analysis from the investment industry itself. These shifts can happen intraday, daily, weekly, or over longer periods. Volatility is often triggered by unforeseen events such as geopolitical tensions (e.g. the Russia-Ukraine war that started in 2022), policy changes (e.g. the shift in monetary policy through changes in interest rates by major central banks in 2025 to combat inflation), or global shocks (e.g. the April 2025 trade war escalation by the US administration), but it can also stem from overreaction to short-term forecasts and the influence of high-frequency trading.

Importantly, volatility doesn’t just reflect risk, it also creates opportunity. It is not something to fear, but something to understand. For asset managers and investors alike, periods of market turbulence can be a chance to identify mispriced assets, reassess sectors and regions, and uncover potential for unrecognised growth.

Understanding risk and why avoiding it can be risky

Avoiding risk might seem like the safest choice, but it can actually create new risks. If you keep too much money in cash or in very low-return investments, your wealth may not grow enough to meet your long-term goals over the long run. Inflation can erode purchasing power, meaning your money buys less over time. Treating market volatility as a reason to avoid investment risk has an opportunity cost: you might miss out on the best opportunities for future growth. There’s an important difference between prudent patience (waiting for the right moment while sticking to a long-term plan) and passive inertia (doing nothing out of fear). The first is strategic; the second can leave you falling behind financially. In essence, the objective isn’t to avoid risk entirely, but to manage it effectively.

Managing volatility effectively

Risk can’t be eliminated, but it can be managed. One of the most effective ways is diversification i.e. the concept of not putting all your eggs into one basket. This can be achieved by spreading investments across different asset types, sectors, and regions which helps reduce the impact of any single event and smooths out the overall investment experience. It also allows investors to benefit from areas of the market that may be thriving even when others are struggling. This is an important element of our portfolio construction for the atomos portfolios that you are invested in.

For active managers within your portfolio, managing risk also means engaging directly with companies, understanding their strengths and weaknesses, and building informed views on future earnings potential. Volatility can expose inefficiencies in the market and skilled active managers can exploit those inefficiencies through thoughtful, targeted analysis. Our portfolios use a combination of active and “semi-active” managers strategies to take advantage of a manager’s skill of exploiting these inefficiencies, whilst also using passive allocations to get access to overall market returns.

Aligning risk with long-term goals

Risk should always be considered in the context of your goals. Whether you’re investing for retirement, education, or building wealth, some level of risk is necessary to get there. The key is to take the “goldilocks” level of risk, (not too much, not too little), and to stay focused on the bigger picture. When investors understand that volatility is part of the journey, they’re better prepared to stay the course. Further, when asset managers treat volatility not as a threat but as a source of opportunity, portfolios are better positioned to benefit.

In summary

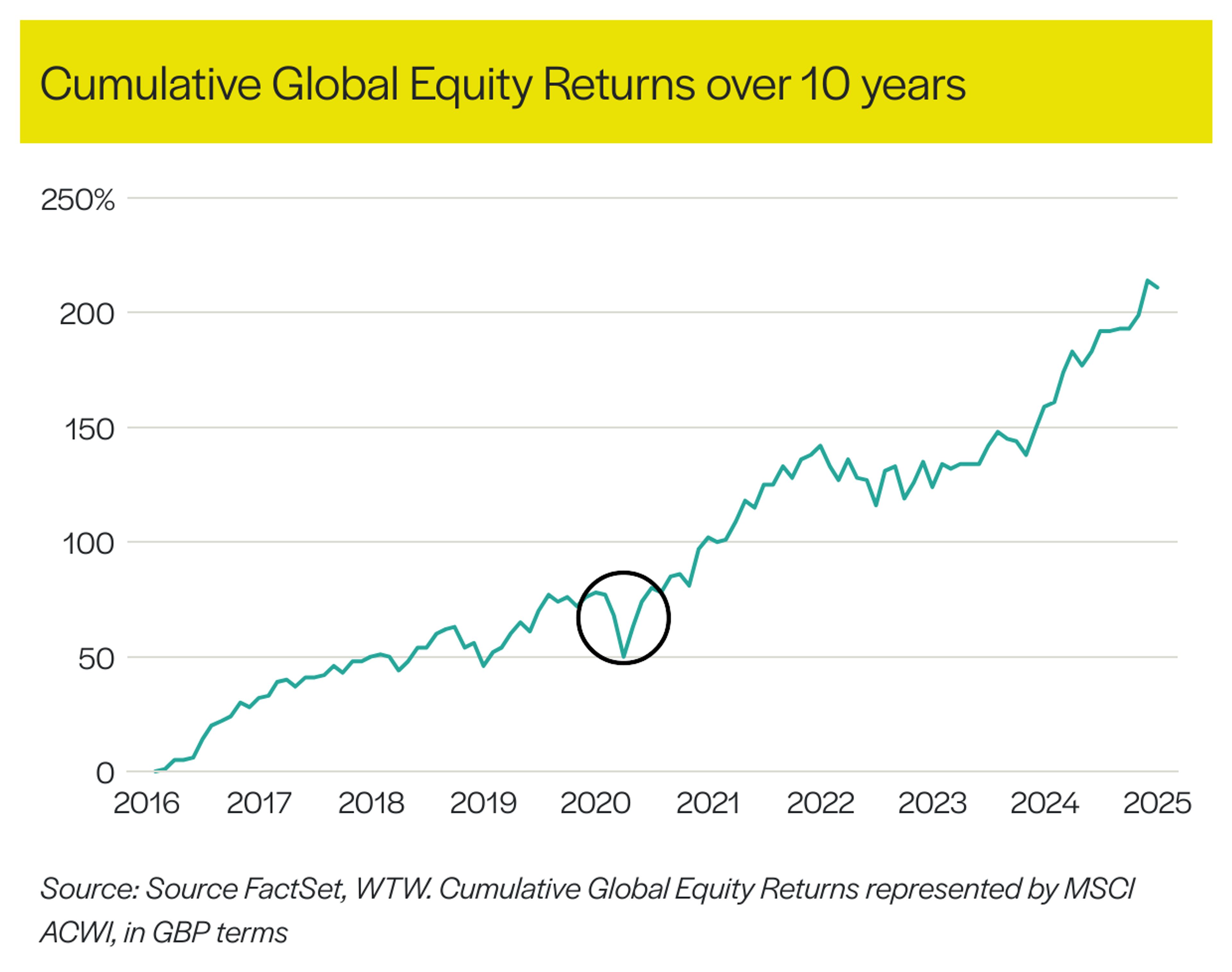

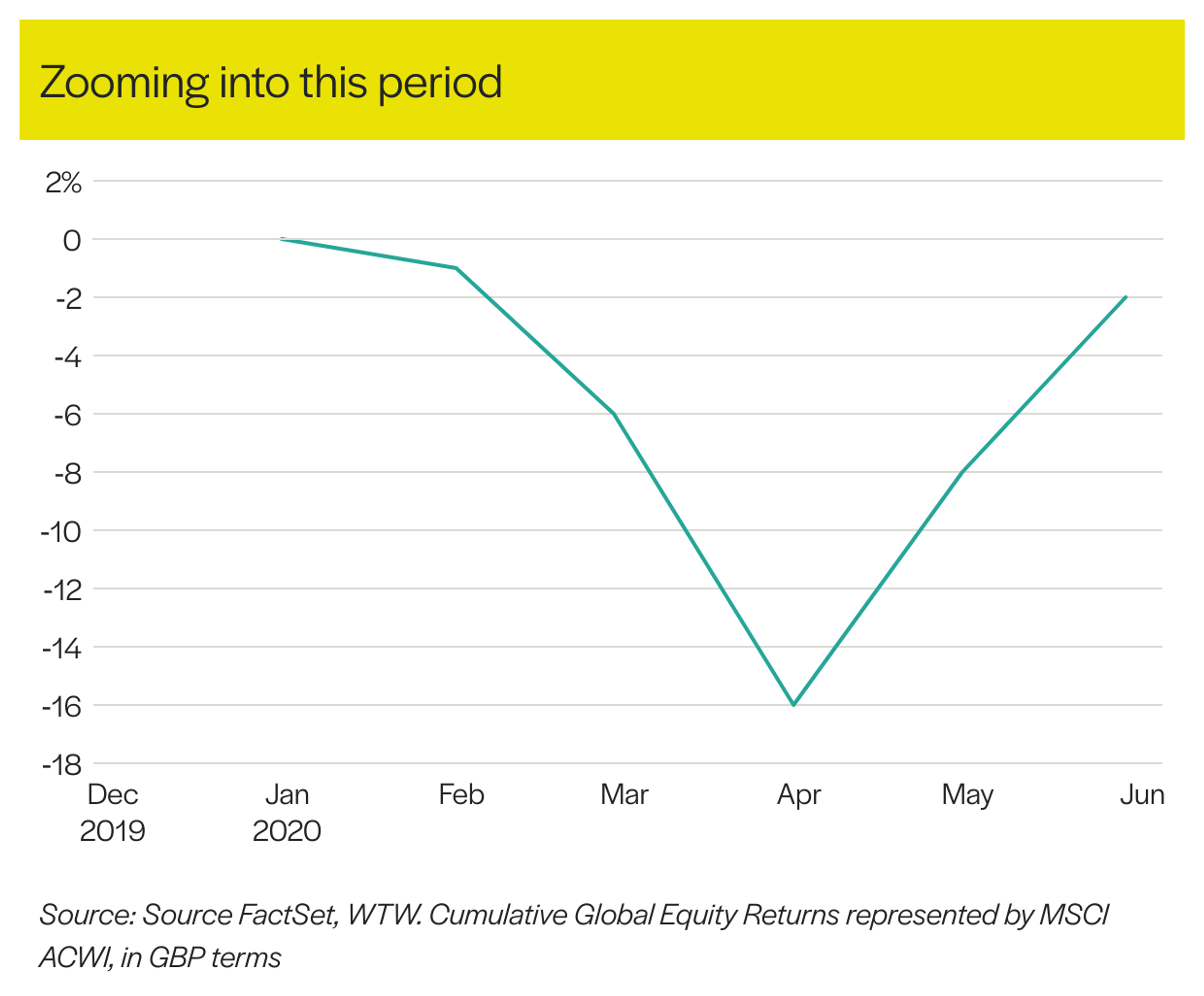

Historical data shows that markets generally trend upward over the long term despite short-term wobbles. Investors who remain invested through market ups and downs tend to achieve better long-term performance though it is always important to remember that past performance is not a reliable indicator of future results. Genuine diversification is crucial for designing a robust portfolio that can navigate various economic environments. While market declines are challenging, it is important to "zoom out" and focus on the big picture, as illustrated below. Ultimately, risk is not something to avoid but a necessary and manageable part of successful investing.