In this article, we dive into the world of market indices—what they are, the different types you’ll encounter, and why they matter. We’ll explore the advantages and drawbacks of using indices as investment tools, and explain how we harness indexation to build smart, diversified portfolios for our clients.

What is an index?

A investment index (which could consist of stocks, bonds, or other assets used by investors) is not just a list of investments with specified weights. It’s more than this. Specifically, it’s a set of rules to create a theoretical portfolio – which can be used by investors in many ways.

The investments that comprise an index are often based on characteristics like specific geographies, industries, or sectors. The index performance may be used to describe the overall performance of an asset class (an asset class is loosely defined as a group of investments with similar characteristics, like “global bonds”, for example). An example of a commonly quoted index is the FTSE100, which is made up of the UK’s largest 100 companies. As the price of those companies rise, the FTSE100 index also rises. The FTSE 100 performance is therefore commonly used to describe or generalise about the performance of the largest UK companies.

Because it is theoretical, an index may or may not be “investable.” By investable, we mean usable as a guide for making investments directly. For example, some indices are not investable due to very high daily turnover (trading) needed to align with them, or they may contain assets that an investor cannot buy. Other indices (like the FTSE100) would be considered “investable”, with assets that can be easily traded and rules that allow an investor to follow the index process without incurring excessive costs. Many such investable indices can now be found as the foundation for a variety of ETFs (Exchange Traded Funds), which aim to deliver the underlying performance of the index portfolio to investors.

How are indices used in the investment industry?

Although initially used as a measure of market, sector, or asset class performance (i.e, “benchmarking”), indices are very important for gaining a better understanding of an active strategy, fund, or investment using more complex analytics.

- Performance Comparison: Comparing a fund’s performance with the index tells you whether the fund made greater gains or losses than the index. It helps you see if the manager added value through active decisions or just followed the market. This is classic “benchmarking.”

- Risk Comparison: Measures how much investment risk (chance of gaining/losing money) the fund is taking compared to the index.

- Performance Attribution: By comparing a fund’s return to the benchmark index, you can understand what caused the relative gains or losses — was your performance a result of bets on specific stocks, or sectors, or something else?

- Risk Attribution: Looks at what kinds of risks the manager is taking—are they different from the average in the market? A fund might generate a higher return over a specific period, but only because it took bigger risks.

Finally, investable indices can be found as the basis for “passive funds” and ETFs, which are the investment vehicles used by investors.

Remember, an index is a theoretical set of rules, not an actual asset – to try and capture its performance, you need to put your money in an investment vehicle (such as a fund) that buys the assets in the index!*

How are indices constructed?

Understanding how an index is built is key, as its design affects how you should use it for performance and risk comparisons – the devil is in the detail. Let’s focus on equity indices, which track groups of companies. Indices in other asset classes like bonds or alternatives (e.g. real estate) are built differently and come with their own challenges.

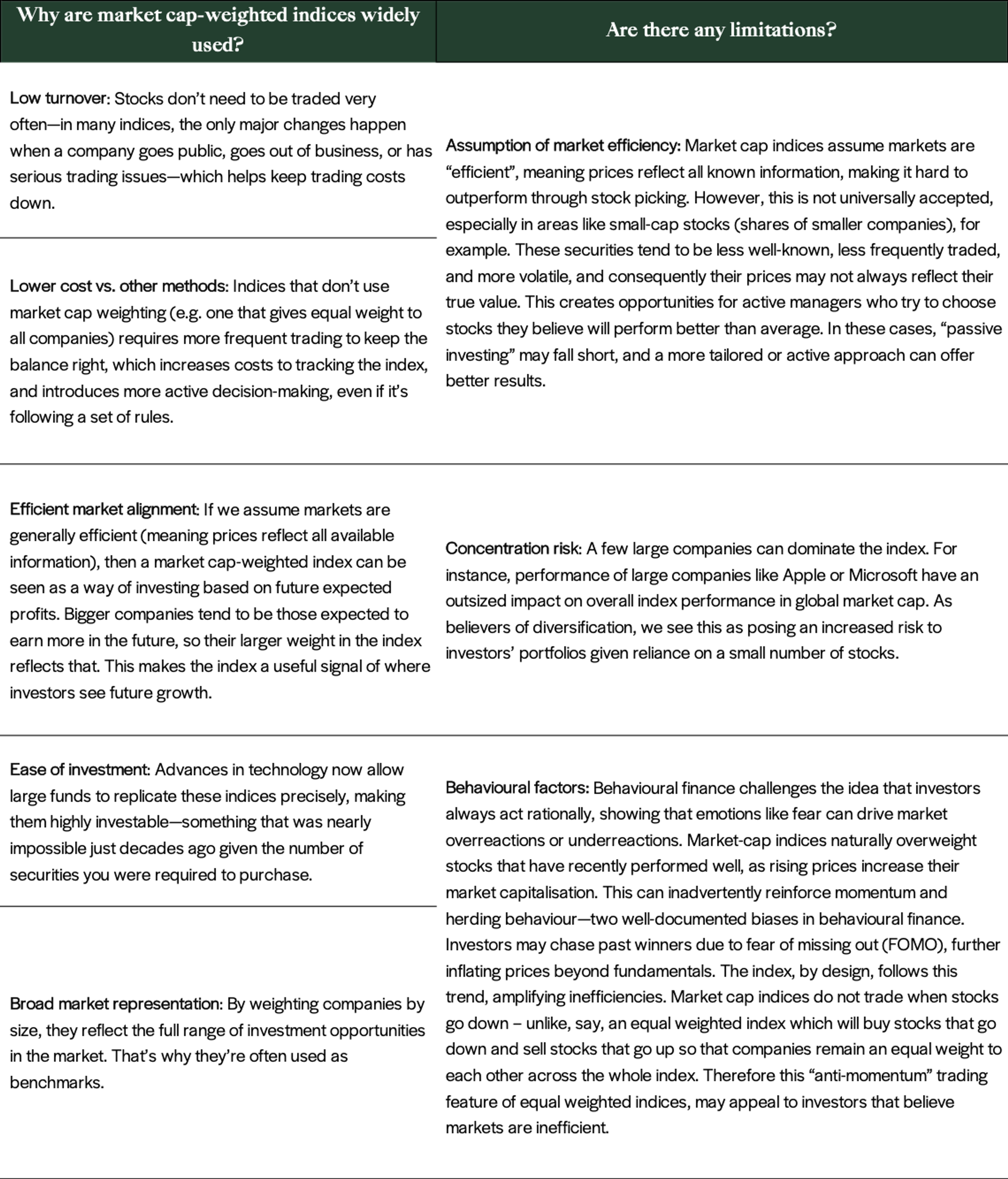

Most major stock indices use market capitalisation weighting. This means each company’s size in the index is based on its market value, which is calculated by multiplying its share price by the number of shares it has issued. Therefore, larger companies like Apple or Microsoft have more influence on the index’s movements than smaller ones. This method is widely used because it reflects the real size and importance of companies in the market and is easy for large funds to track and invest in.

[Note: Some indices refine this further using free-float market capitalisation. This only includes shares available for public trading, excluding those held by insiders, governments, or long-term investors. This gives a more realistic view of what investors can actually buy and sell.]